15 Common Mistakes to Avoid in Personal Finance Management

Most Common Mistakes to Avoid in Personal Finance Management: People often make mistakes when handling their personal money. There are a lot of ways to lose money in life. It’s simple to screw up your finances even if you try your hardest.

However, it’s not just about the errors you’re making; it’s also about the possibilities you’re passing up. Financial hardship, loss of growth chances, and credit score harm can result from these errors. By avoiding these common errors, people can achieve financial security and reach their aims.

15 Most Common Mistakes to Avoid in Personal Finance Management

Here, we’ll look at some of the most typical monetary errors that frequently result in severe financial difficulty. Even if you are already in financial trouble, avoiding these errors may be the difference between life and death.

1. Overspending

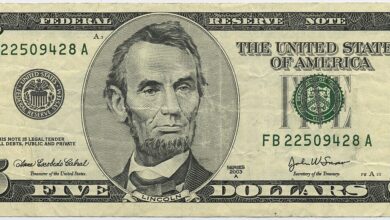

Large sums of money are frequently lost, one dollar at a time. When you purchase that pay-per-view movie, go out to dinner or buy that double-mocha cappuccino, it might not seem like a huge issue, but everything adds up. Spending just $25 a week on eating out costs you $1,300 annually, which could be used to cover several additional credit card, vehicle, or other expenses. Avoiding this error is crucial if you’re struggling financially; after all, if you’re just a few dollars from debt or bankruptcy, every penny will mean more than ever.

2. Constant Recurring Bills

Consider whether you truly require the things that maintain you making payments month after month, year after year. Paying for things like cable TV, streaming audio, or a premium gym subscription can be a never-ending drain on your finances with no tangible benefit. Slimming down your way of living can help you save money in times of financial stress or if you simply want to put more money away.

3. Not Making Retirement Investment

You might never be able to cease working if you do not put your money to work for you in the markets or through other investments that generate revenue. For a comfortable retirement, making monthly payments to specified retirement funds is crucial. Utilize your employer-sponsored retirement plan and/or tax-deferred savings funds. Know how long it will take for your investments to develop and how much danger you can take. If feasible, seek the advice of a seasoned financial advisor to align this with your objectives.

4. Using Credit to Make Ends Meet

Using a credit card to pay for necessities is now a regular practice. Despite the fact that more and more people are prepared to pay interest rates in the double digits for things like petrol and groceries that will be gone long before the account is paid in full, doing so is not financially savvy. The cost of purchases made with a credit card is significantly inflated due to interest charges. Spending more than you have coming in is another risk when using credit.

5. Lack of a Plan

Your money destiny is dependent on the current situation. Setting aside two hours a week for your money is impossible when people waste countless hours viewing TV or scrolling through social media. You must be aware of your destination. Make time for financial preparation a top concern.

6. Not having a budget

Many people don’t have a budget, which is the most fundamental aspect of personal finance management. A budget is a plan that allows you to track your income and expenses and help you make informed financial decisions.

7. Not reviewing financial statements

It’s essential to review your financial statements regularly, including bank statements, credit card statements, and investment statements. This helps you identify errors and fraudulent activity and track your spending.

8. Paying Off Debt With Savings

If your debt is 19% and your retirement account is 7%, trading the retirement for the debt could net you the difference. It’s complicated. In addition to losing growth, it’s difficult to repay retirement funds, and you may incur high fees. Borrowing from your retirement account is possible with the right mindset, but even the most disciplined managers struggle to save money to rebuild these funds. Paying off debt usually reduces the desire to repay. It will be enticing to keep buying, which could lead to debt again. To pay off debt with money, you must live like you owe your retirement fund.

9. Neglecting to negotiate

Negotiating can be a powerful tool to save money on bills, reduce debt, and secure better financial deals. Failing to negotiate can cost you significant amounts of money over time.

10. Not seeking financial advice

Seeking financial advice from experts can help you make informed decisions and avoid costly mistakes. Failing to seek advice can lead to missed opportunities and financial losses.

11. Using credit cards irresponsibly

Credit cards can be a helpful tool for building credit and managing cash flow. However, using them irresponsibly can lead to high-interest debt and a damaged credit score.

12. Failing to diversify

Investing in a single asset or market can be risky. Failing to diversify your investments can leave you vulnerable to losses if a particular asset or market declines. Diversification can help minimize risk and protect your financial stability.

13. Making Important Purchases Without Comparing Prices

Customers frequently stay with their current options when it comes to regular costs like auto insurance. Shopping around, though, is beneficial. Customers who check their accounts before renewing and look around can frequently save hundreds of dollars annually! Even if you continue doing business with the same provider, check your coverage to see if you’re carrying more insurance than is required.

14 Investing in a Brand-New Ride

Don’t go out and purchase a brand-new car because you can comfortably handle the monthly payments. Vehicles lose worth as they get older, a phenomenon known as depreciation. In the first year of possession, a brand-new vehicle loses 20-30% of its worth.

Used cars are a better deal than new ones because depreciation rates drop rapidly within the first two years. Certified pre-owned cars are offered by many carmakers, and they are usually two to three years old and have minimal mileage. In most cases, these packages also include a maker guarantee and a complete overhaul of the car. You get all the benefits of a new vehicle at a much better price, and all you have to give up is the new car scent, which is just toxic materials off-gassing.

15. Falling for scams

Falling for scams is a common financial mistake because it can result in significant financial losses and even identity theft. Scammers use various tactics to deceive people, such as phishing scams, investment scams, and online shopping scams, among others.

These scams can come in the form of emails, phone calls, or social media messages. Falling for a scam can result in the loss of money or personal information, which can be used to steal your identity and access your bank accounts or credit cards.

Scammers often prey on people who are vulnerable, such as those facing financial difficulties or older adults. It’s essential to stay informed about the latest scams and to be cautious when sharing personal information or making financial transactions online. By being vigilant and taking steps to protect yourself, you can avoid falling for scams and protect your financial security.

Read: Best 15 Cheapest Universities in Italy for International Students (2023)

FAQs & Answers

Why is it important to diversify investments?

Diversifying your investments can help minimize risk and protect your financial stability. Investing in a single asset or market can be risky, and failing to diversify can leave you vulnerable to losses if that asset or market declines.

How can I avoid overspending?

You can avoid overspending by creating a budget and sticking to it. It’s also helpful to avoid impulse purchases, wait for sales or discounts, and focus on your needs rather than wants.

Why is it important to have an emergency fund?

An emergency fund is essential because unexpected expenses can arise at any time, such as a car repair or medical bill. Having an emergency fund can help you manage these expenses without disrupting your financial stability.

How can I avoid falling for scams?

To avoid falling for scams, be cautious when sharing personal information or making financial transactions online. Stay informed about the latest scams, and never give out your personal information to anyone you don’t know or trust.

How can I negotiate my bills and reduce my debt?

You can negotiate your bills by contacting your service providers and asking for discounts or reduced rates. You can also negotiate with creditors to reduce your debt or set up a payment plan.

Should I seek financial advice?

Seeking financial advice from experts can help you make informed decisions and avoid costly mistakes. Financial advisors can provide guidance on budgeting, saving, investing, and retirement planning. It’s important to choose a reputable advisor and make sure their services align with your financial goals.

Conclusion

Avoid the perils of overspending by keeping tabs first on the small purchases that build up fast before moving on to the larger ones. You should give adding new obligations to your list of payments some serious thought. Just because you can make the payment doesn’t mean you can afford the buy. Finally, create a solid financial strategy and make saving a regular part of your budget.

Here are the most common mistakes to avoid in personal finance management.

Recommended:

Budgeting: Key to Personal Finance Management

12 Essential Tips For Investing In Stocks (2023 Ultimate Guide)